The Ohio Department of Education is pleased to announce changes to the Afterschool Child Enrichment (ACE) educational savings account program.

Qualifying families can receive a $1,000 credit per child for enrichment and educational activities during the 2023-2024 school year. Allowable activities include educational programs, day camps, music lessons, tutoring and more.

Expanded eligibility includes children ages 6-18 whose family income is at or less than 400% of the Federal Poverty Level, who participate in income-based programs such as Medicaid, SNAP, and Ohio Works First, or who reside in districts identified as experiencing high rates of chronic absenteeism or include EdChoice-eligible schools.

“The changes to the Ohio ACE program provide more students access to educational activities outside of the traditional classroom,” Interim Superintendent of Public Instruction Dr. Stephanie Siddens said. “The ACE Marketplace helps parents extend and enrich learning opportunities and broaden experiences for their children.”

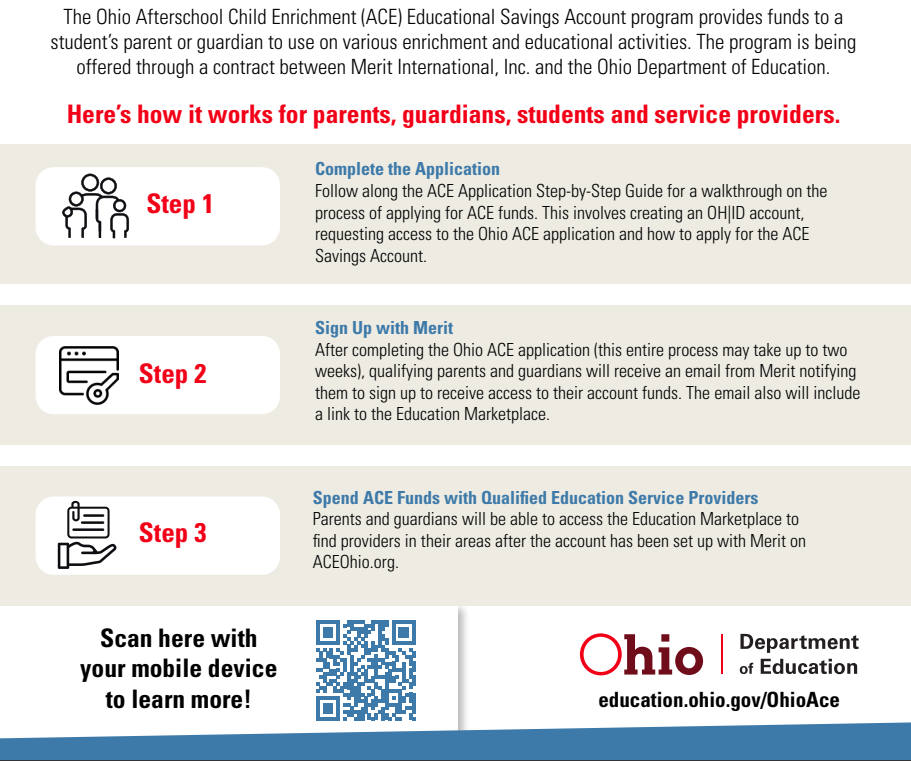

Administered by the Ohio Department of Education and Merit International, Inc., the ACE program provides access to educational activities to students who experienced learning disruptions during the COVID-19 pandemic.

ACE Providers in Southwest Ohio

Every day, new programs are added to the ACE marketplace in Ohio. Families can peruse available enrichment like camps at the Cincinnati Zoo, summer STEM academy camps at Drake Planetarium, monthly art classes at Artful Gathering, after-school at YMCA of Greater Dayton, performances at Dayton Live and hundreds more!

Eligible Students

The ACE Educational Savings Account program is available to any Ohio child ages 6 to 18 years old (who hasn’t graduated from high school) who meets at least one of the conditions below.

Residency

Children residing in districts identified as having a high rate of chronic absenteeism or have one or more schools identified as EdChoice eligible qualify for an ACE Educational Savings Account.

- 2023-24 School Year

- Effective July 1, 2023

Income

Children who reside in a household with an Adjusted Gross Income (AGI) at or below 400% of the federal poverty level based on the household’s most recent federal income tax return qualify for an ACE Educational Savings Account.

- 2023-24 School Year

- Effective beginning July 1, 2023

Income-based Goverment Assistance

Children who are part of a family that participates in programs such as Medicaid, Supplemental Nutrition Assistance Program (SNAP), Ohio Works First (OWF) or other income-based government assistance programs with eligibility at or below 400% of the federal poverty level, qualify for an ACE Educational Savings Account.